Newly MOP-ed flats appeal to largely to younger families or singles who want a new home without the wait.

With the Singapore government recently announcing an

increase in grants for first-time buyers of resale HDB flats, we expect at least some home-seekers to set their sights (i.e. budgets) higher when home hunting. In the coming months, we could be seeing a boost in demand for newer HDB flats – especially projects that have recently attained their

Minimum Occupation Period (MOP).

Why buy a newly MOP-ed HDB resale flat?

Under HDB regulations, owners must live in a newly-bought HDB flat for five years before they are allowed to sell their property – a move intended to curb speculation and ‘flipping’. This applies to both Build-to-Order (BTO) and

resale flats.

For BTO projects, the entire cluster of blocks will tend to hit MOP at around the same time. Once this happens, there will inevitably be a handful of first-time owners looking to cash in a profit for their unit, thanks to the below-market-value price of flats sold in BTO sales launches.

With around 94 out of 99-years of lease remaining, newly MOP-ed flats certainly appeal to buyers, especially among younger families and singles alike who want a new flat without the wait, while getting a remaining lease that can last their lifetimes with potential for upside in a 5- to 15-year time frame.

At the very least, the newer a flat, the more resilient its value would be even if the economy or the property market doesn’t do so well in the same time period.

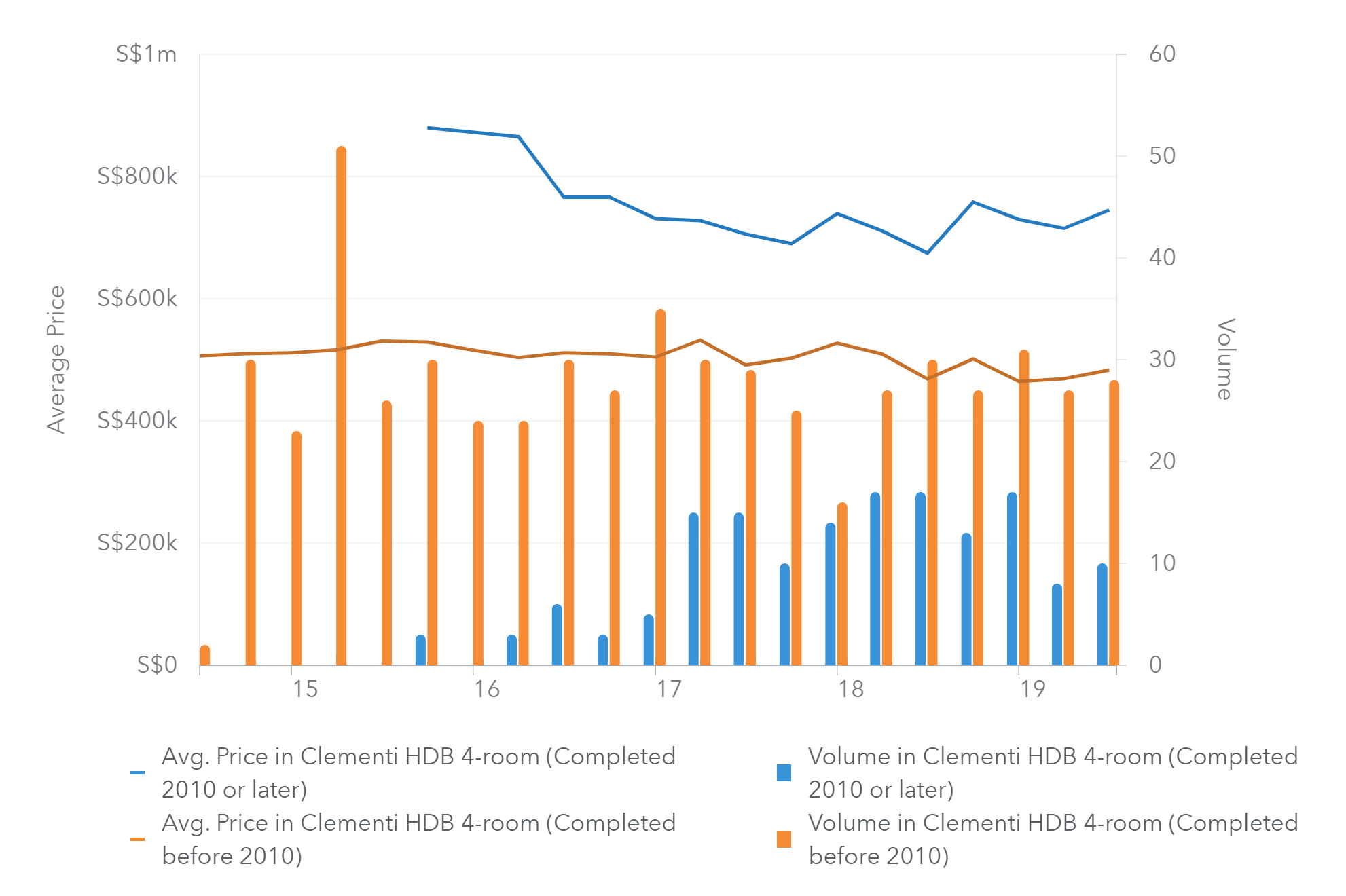

So even though newly MOP-ed HDB flats command a significant price premium over older flats, there are still buyers able and willing to pay the extra money. This is the case with Clementi, where new flats typically command a 50% price premium or more compared to older flats:

Keen to scope out which new HDB projects have reached their MOPs? We’ve compiled a list for you:

West Region

Newly MOP-ed HDB #1: Boon Lay Fields

Proof that a good location does not necessarily have to mean “walking distance to MRT”

Town: Jurong West

Number of units: 491

Unit types: 3-room, 4-room, 5-room

BTO launch price (4-room): $270,000 – $321,000

Average listed price (4-room): $494,000

What’s hot:

- Blocks in this development resemble point blocks, with a low unit-to-floor ratio of minimum 4 units per level (maximum 6)

- Blocks are spaced relatively far apart so you don’t feel the need to close your curtains all the time

- Nearly half of the units here are Southeast-facing, hence avoiding exposure to the afternoon sun

- Largely unblocked views for Northwest and Southeast-facing units

- Service yards don’t face the corridor; some even offer panoramic views

- At the doorstep of daily necessities; just across the street from Boon Lay Shopping Complex and Boon Lay Place Food Village (Power Nasi Lemak anyone?)

- Walking distance to River Valley High School

- Within 1km of Boon Lay Garden Primary School, Rulang Primary School and Lakeside Primary School

What’s not:

- A minimum 10-minute walk from the nearest MRT station (Lakeside MRT)

North Region

Newly MOP-ed HDB #2: Montreal Ville

A recreational haven for those who love peace and quiet

Town: Sembawang

Number of units: 578

Unit types: 2-room, 3-room, 4-room

BTO launch price (4-room): $255,000 – $310,000

Average listed price (4-room): $425,000

What’s hot:

- Quiet and tranquil living environment

- Many Southeast-facing units with no exposure to the afternoon sun, ever

- Mid-to-high floor southeast-facing units also enjoy a permanently unblocked view over landed housing cluster across the road

- Walking distance to upcoming integrated sport and community hub, Bukit Canberra

- Canberra might be the property location to watch in the coming years

What’s not:

- Currently, only 3 out of 5 blocks have only one primary school (Wellington Primary School) within 1km, although URA has allocated land for at least two more

- Outside of walking distance to upcoming Canberra MRT

- Daily necessities not immediately accessible

Newly MOP-ed HDB #3: Yishun Riverwalk

A large development with childcare facilities

Town: Yishun

Number of units: 1,408

Unit types: Studio, 3-room, 4-room, 5-room

BTO launch price (4-room): $214,000 – $268,000

Average listed price (4-room): $420,000

What’s hot:

- Food court, mini-mart, shops and childcare centre within the project

- Walking distance to Junction 9, a compact shopping mall with a full range of shops, including a Sheng Siong supermarket

- Slightly more space between blocks compared to the nearby, newly MOP-ed Yishun Greenwalk

- Within 1km of 3 to 4 primary schools, depending on which block

What’s not:

- A 10- to 15-minute feeder bus ride to Yishun Town Centre (Northpoint City; Yishun MRT)

East Region

Newly MOP-ed HDB #4: Costa Ris

Pasir Ris Town’s one and only BTO project so far

Town: Pasir Ris

Number of units: 1,386

Unit types: 2-room, 3-room, 4-room, 5-room

BTO launch price (4-room): $294,000 – $347,000

Average listed price (4-room): $550,000

What’s hot:

- Pasir Ris has ample recreational amenities (Pasir Ris Park, Downtown East etc.)

- Food court, supermarket (Sheng Siong), shops and preschool/kindergarten within the project

- Most blocks within 7-minute walking distance to Pasir Ris Central (White Sands, Pasir Ris MRT)

- Many Northwest- and North-facing units that avoid the afternoon sun

- Property in Pasir Ris might present further upside the coming years, with an upcoming integrated hub at Pasir Ris Central and Cross Island Line MRT development

- Future Pasir Ris MRT (Cross Island Line) station to border the northern edge of Costa Ris with station entrance and underground connection to Pasir Ris Central

What’s not:

- Blocks located nearer to Pasir Ris Central are sited quite a distance from the Multi-Storey Car Park, which is near the southern end of the project. Drivers take note

- Blocks closer to Pasir Ris Central have only one primary school within 1km (Elias Park Primary)

- Blocks mostly quite densely packed

- Units facing main road and Tampines Expressway might present noise concerns

- Pasir Ris is a relatively new estate built in the early 90s; these earlier, cheaper Pasir Ris flats are typically more spacious and can still be considered quite new

Newly MOP-ed HDB #5: Tampines Greenleaf

No other BTO project is as near to Tampines Town Centre as this

Town: Tampines

Number of units: 960

Unit types: 2-room, 3-room, 4-room, 5-room

BTO launch price (4-room): $320,000 – $361,000

Average listed price (4-room): $595,000

What’s hot:

- Preschool/kindergarten within development

- Walking distance to Tampines MRT Station (Downtown Line)

- Walking distance to Our Tampines Hub

- Walking distance to Sun Plaza Park

- All blocks within 1km of Poi Ching School

- Potential future commercial developments around Tampines Downtown Line MRT station

What’s not:

- Few units with unblocked view

- Slightly beyond walking distance to/from Tampines Town Centre (Shopping Centres, Offices, East West Line MRT station)

- Blocks in the northern half of the project only have one primary school within 1km

North-East Region

Newly MOP-ed HDB #6: Punggol Emerald

A development with ample communal landscaped spaces and within touching distance of Punggol MRT station

Town:

Punggol

Number of units: 856

Unit types: 2-room, 3-room, 4-room, 5-room

BTO launch price (4-room): $262,000 – $323,000

Average listed price (4-room): $505,000

What’s hot:

- Within walking distance of Punggol MRT station and Bus Interchange

- LRT station (Soo Teck) at doorstep, for those feeling lazy

- Within walking distance of Waterway Point

- Ample communal landscaped spaces, including a large common green en route to the MRT station

- Some units get a glimpse of the swimming pool of a neighbouring condominium

- A convenience store and a clinic within the development

- Preschool/kindergarten, food court and shops at adjacent developments

- Within 1km of two primary schools currently

- Future primary and secondary school right across the road

What’s not:

- Many units face Northwest with exposure to afternoon sun

Newly MOP-ed HDB #7: Fernvale Riverbow

An idyllic setting along Sungei Punggol, a legit river (not a longkang)

Town:

Sengkang

Number of units: 1,154

Unit types: 3-room, 4-room, 5-room

BTO launch price (4-room): $246,000 – $315,000

Average listed price (4-room): $460,000

What’s hot:

- Idyllic riverfront living with a number of river-facing units

- Scenic park connector leading to Punggol Waterway

- Ample common landscaped areas within development

- Walking distance to Layar MRT station

- Within walking distance of Seletar Mall and upcoming community hub at Fernvale

- At least three primary schools within 1km distance of development

- At the doorstop of Pei Hwa Secondary School

- Childcare and preschool/kindergarten within development

- Permanent unblocked views for units along southern boundary of the development (overlooking low-rise condo and landed estate)

What’s not:

- About 10-15 minutes away from Sengkang MRT and Town Centre via LRT; consider Anchorvale Isles if you would like to be nearer

- Planned roads on the southern edge of the development and across the river might diminish the serenity of the place